glenwood springs colorado sales tax rate

Seller collects sales tax for items shipped to the following states. On November 3 2015 Colorado Springs voters approved a sales and use tax rate increase of 062 to fund road repair maintenance and improvements.

Marijuana Sales Tax Department Of Revenue Taxation

State of Colorado 290 Garfield County 100 RTA Rural Transit Authority 100 City of Glenwood Springs.

. Effective with January 2014 sales tax return the penalty interest rate has changed to 5. This is the total of state county and city sales tax rates. The Colorado sales tax rate is currently.

Automating sales tax compliance can. Garfield County Colorado has a maximum sales tax rate of 86 and an approximate population of 37765. What is the sales tax rate for the 81601 ZIP Code.

Glenwood Springs is located within Garfield County Colorado. Has impacted many state nexus laws and sales tax collection requirements. Sales tax rates in Garfield County are determined by eight different tax jurisdictions Silt Rifle De Beque Parachute New Castle Garfield Glenwood Springs and Glenwood Sprgs Roaring Fork Rta.

To review these changes visit our state-by-state guide. The Glenwood Springs Colorado sales tax is 290 the same as the Colorado state sales tax. Above taxes plus City Accommodation Tax.

The County sales tax rate is. Learn about sales tax rates sales tax returns and more. The sales tax rate does.

The average cumulative sales tax rate in Glenwood Springs Colorado is 86. 250 Total Tax rate with Accommodation Tax. Above taxes plus City Accommodation Tax.

The 2018 United States Supreme Court decision in South Dakota v. City Hall 101 W 8th Street Glenwood Springs CO 81601 Phone. The latest sales tax rate for Glenwood Springs CO.

The Colorado sales tax rate is 29 the sales tax rates in cities may differ from 325 to 104. Glenwood Springs in Colorado has a tax rate of 86 for 2022 this includes the Colorado Sales Tax Rate of 29 and Local Sales Tax Rates in Glenwood Springs totaling 57. Method to calculate Glenwood Springs sales tax in 2021.

This includes the sales tax rates on the state county city and special levels. The minimum combined 2022 sales tax rate for Glenwood Springs Colorado is. 250 Total Tax rate with Accommodation Tax.

The estimated 2022 sales tax rate for 81601 is. Within Glenwood Springs there are around 2 zip codes with the most populous zip code being 81601. 2021 the City of Colorado Springs sales and use tax rate has decreased from 312 to 307 for all transactions occurring on or after that date.

The Glenwood Springs sales tax rate is. Did South Dakota v. As we all know there are different sales tax rates from state to city to your area and everything combined is the required tax rate.

MUNIRevs allows you to manage your municipal taxes licensing 24x7. Tax rates are provided by Avalara and updated monthly. Download all Colorado sales tax rates by zip code.

For tax rates in other cities see Colorado sales taxes by city and county. The 86 sales tax rate in Glenwood Springs consists of 29 Colorado state sales tax 1 Garfield County sales tax 37 Glenwood Springs tax and 1 Special tax. The combined amount is 820 broken out as follows.

Sales Tax Rates in the City of Glenwood Springs. This rate includes any state county city and local sales taxes. State Sales Tax Rate Tax applies to subtotal shipping handling for these states only.

Look up 2022 sales tax rates for Glenwood Colorado and surrounding areas. The Glenwood Springs Colorado sales tax is 860 consisting of 290 Colorado state sales tax and 570 Glenwood Springs local sales taxesThe local sales tax consists of a 100 county sales tax a 370 city sales tax and a 100 special district sales tax used to fund transportation districts local attractions etc. The average sales tax rate in Colorado is 6078.

You can print a 86 sales tax table here. Sales Tax Rates in the City of Glenwood Springs. 2020 rates included for use while preparing your income tax deduction.

If you need assistance see the FAQ. To begin please register or login below. City Hall 101 W 8th Street Glenwood Springs CO 81601 Phone.

While Colorado law allows municipalities to collect a local option sales tax of up to 42 Glenwood Springs. The Glenwood Springs Sales Tax is collected by the merchant. You can find more tax rates and allowances for Glenwood Springs and Colorado in.

State of Colorado 290 Garfield County 100 RTA Rural Transit Authority 100 City of Glenwood Springs. Sales Tax Rates in the City of Glenwood Springs. What is the sales tax rate in Glenwood Springs Colorado.

Cancellation 1911 Vintage Postcard- 708.

Where To File Sales Taxes For Colorado Home Rule Jurisdictions Taxjar

Iowa Sales Tax Rates By City County 2022

Missouri Sales Tax Rates By City County 2022

February Sales Tax Reports Show Business Is Booming In Summit County Summitdaily Com

Special Event Sales Tax Department Of Revenue Taxation

Locating And Discovering Sales Tax Medical Icon Sales Tax Medical

New Mexico Sales Tax Rates By City County 2022

Colorado Sales Tax Rates By City

Colorado And Denver Marijuana Taxes Rank Near Top And May Grow Axios Denver

Georgia Sales Tax Rates By City County 2022

Arkansas Sales Tax Calculator Reverse Sales Dremployee

Washington Sales Tax Rates By City County 2022

Colorado Sales Tax Rates By City

Florida Sales Tax Rates By City County 2022

Alabama Sales Tax Rates By City County 2022

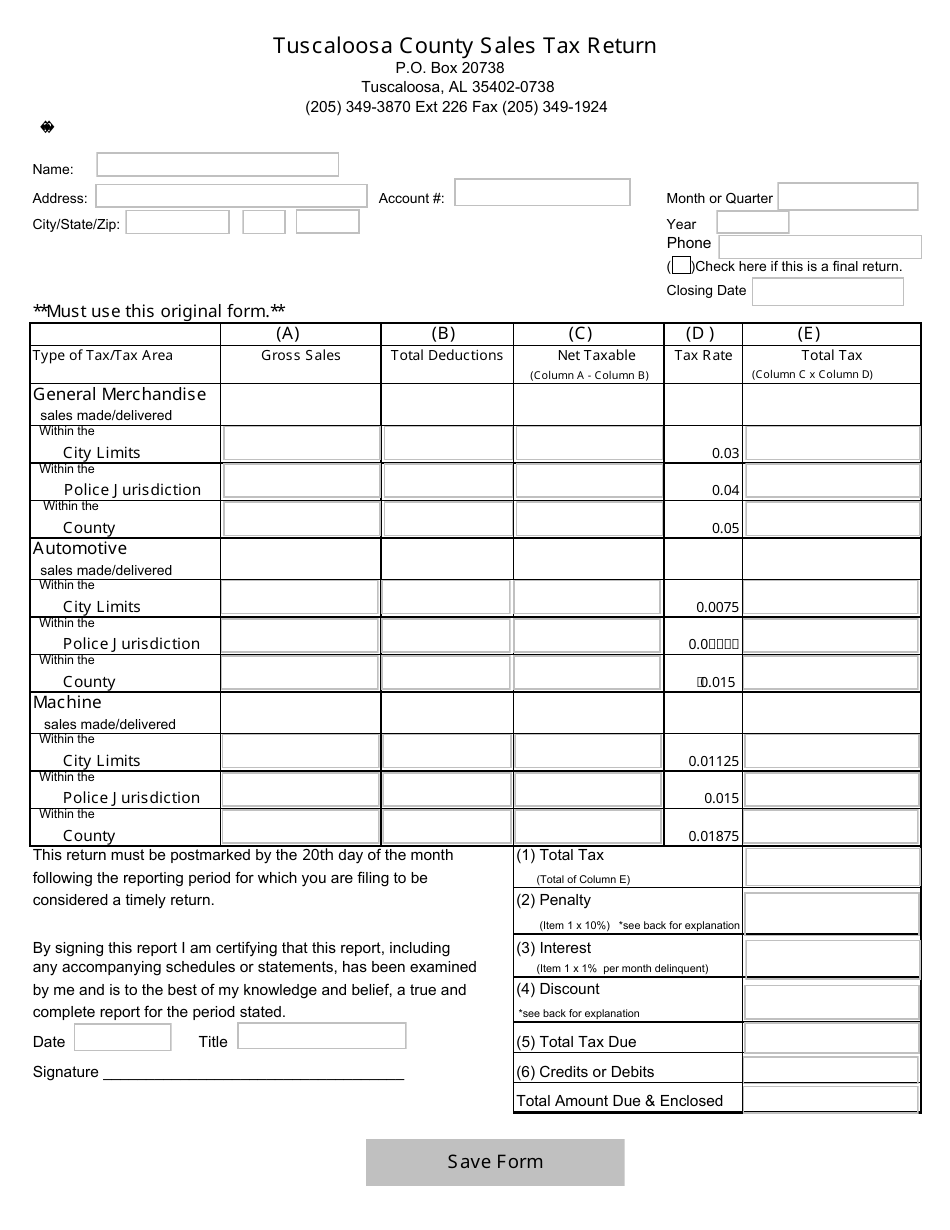

City Of Tuscaloosa Alabama Sales Tax Return Form Download Fillable Pdf Templateroller

City Of Tuscaloosa Alabama Sales Tax Return Form Download Fillable Pdf Templateroller